The addy proforma takes assumptions from the Issuer's proforma and translates them into a one-pager, allowing a potential investor to adjust the investment amount, interest rate, and exit cap rate based on their own assumptions.

Note:

The proforma works on Microsoft Excel only and will not work with other applications.

Download the proforma

- Login to your addy account.

- On the left, click the Properties Tab.

- Select the property you want.

- Scroll to the Confidential Due Diligence and locate the Financial Section.

- Download and open the addy proforma excel version.

- You can use the proforma on Microsoft Excel only.

How to use the addy proforma

There are three inputs you can enter: Investment $, Interest Rate, and Exit Cap Rate.

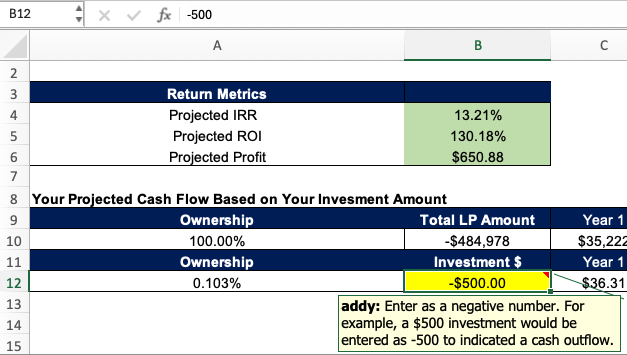

Investment $

Your investment $ is the amount you are interested in investing into the property.

- Input: Click on the Investment $ cell highlighted in yellow and enter the amount you would like to invest in the property with a negative sign. This investment amount cannot exceed the Total LP Amount indicated above it (it is -$484,978 in this example).

- Example: If you would like to invest $500.00, enter

-500into the cell.

- Example: If you would like to invest $500.00, enter

- Reference: The total investment amount (called Total LP Amount in this example) available is displayed directly above your investment amount for reference.

- Example: It is $484,978, displayed as

-$484,978.

- Example: It is $484,978, displayed as

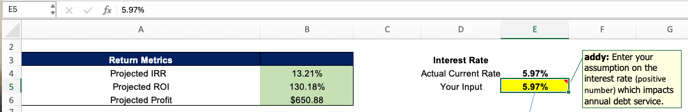

Interest Rate

Adjust the interest rate affects the cash flow available to an investor. The higher the interest rate, the higher the payments on the mortgage. Learn more about interest rates here and how it impacts a property.

- Input: Click on the Interest Rate cell highlighted in yellow and enter your interest rate assumption. The interest rate has to be a positive number.

- Example: If you assume the interest rate is 5.97%, enter

5.97%into the cell.

- Example: If you assume the interest rate is 5.97%, enter

- Effect: Adjusting the interest rate changes the annual debt service.

- Definition: Annual debt service refers to the total amount of money that a borrower is required to pay in a year to cover the repayment of interest and principal on a debt.

- Note: A higher interest rate increases the annual debt service payments.

- Reference: The actual current interest rate is displayed directly above your input cell for reference.

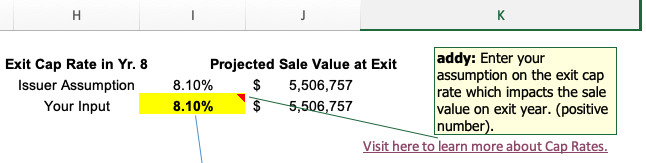

Exit Cap Rate

Adjusting the exit cap-rate changes the sale value of the property at sale year (in this example, it is 8.10%) Learn more about cap rates here.

- Input: Click on the Exit Cap Rate cell highlighted in yellow and enter your exit cap rate assumption.

- Example: If you assume the exit cap rate is 8.10%, enter

8.10%into the cell. This will adjust your projected sale value at exit.

- Example: If you assume the exit cap rate is 8.10%, enter

- Effect: Adjusting the exit cap rate changes the sale value of the property at the exit year.

- Note: A lower exit cap rate increases the value of the property.

- Reference: The Issuer's assumed exit cap rate is displayed directly above your input cell for reference along with the projected sale value at exit.

- Example: In this example, year 8 is the exit year.