How to read and reconcile EFT activity in your wallet

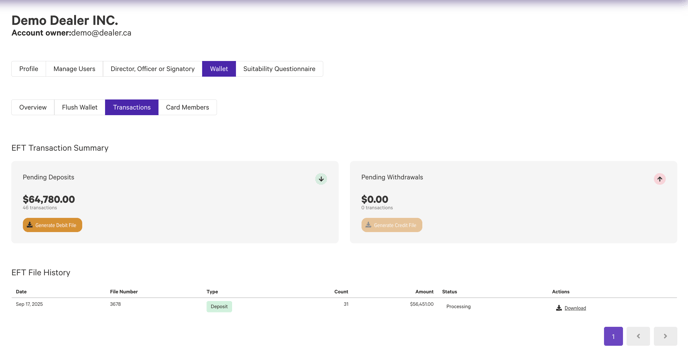

The Transactions tab in your wallet is where you’ll see all deposit and withdrawal activity tied to a Issued Card. This page is designed to give dealers a clear picture of what’s waiting to be processed, what’s already in motion, and how to match it against your bank records.

Pending Deposits 💸

This shows the total amount of investor funds that have been added to their wallets but not yet swept into your trust account.

-

These funds are waiting to be included in an EFT debit file.

-

Once you generate and upload that file to your bank, the funds will move out of “pending” and into your trust account.

Pending Withdrawals ↗️

This shows the total amount of investor withdrawals or refunds that have been requested but not yet sent out.

-

These funds are waiting to be included in an EFT credit file.

-

Once you generate and upload that file to your bank, the payouts will move out of “pending” and into investors’ external accounts.

EFT File History

Every time you generate an EFT file (debit or credit), it shows up here with key details:

-

Date: The day the EFT file was generated.

Note: This is the generation date only. The actual settlement with your bank usually takes up to 7 business days.

-

File Number: A unique identifier for that batch.

-

Type: Either Deposit (debits from investors) or Withdrawal (credits to investors).

-

Count: Number of transactions in the file.

-

Amount: The total dollar value of the batch.

-

Status:

-

Processing: File has been generated and submitted.

-

Completed: File has been fully settled by the bank.

-

Failed: File was rejected.

-

-

Actions: Download the EFT file for your records or for troubleshooting.

Reconciling with Your Bank

When it’s time to reconcile:

-

Start with the Date and Amount in your EFT File History.

-

Use the 7-business-day window after the file generation date as your reference period in your bank statement.

-

Look for a transaction in your trust account that matches the EFT file amount.

-

If it matches, the batch cleared correctly.

-

If no match appears within the window, or if the amounts differ, check the file status in your wallet and confirm with your bank whether any transactions were rejected.

👉 For step-by-step instructions on actually creating and submitting debit/credit files, see: How to process EFT debits and credits.